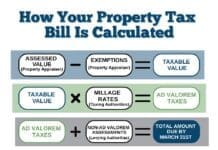

We’re still a few months away from collecting property taxes, but as new residents move to Bay County we wanted to makes sure all taxpayers understand the property tax cycle in Florida.

Each state’s property tax laws are different. Collection times vary between states as do the names of the agencies responsible for collecting. If you own property in multiple states, or if you are new to Florida, you may be unfamiliar with the specifics regarding Florida’s property tax process and cycle.

In Florida, the Property Appraiser is responsible for maintaining the tax roll. If you have questions regarding your property assessment, need to update your address on your property tax account, or want to apply for an exemption, you will need to contact the Property Appraiser’s Office at (850) 248-8401 or online at BayPA.net.

Florida collects property taxes in arrears meaning property is assessed on January 1, but you are not billed until November 1. Property owners have from November through March to pay property taxes before they become delinquent.

This month the Property Appraiser will be sending out the TRIM notice. This notice shows an estimate of your property taxes based on the proposed millage rates of the taxing authorities, property values and current exemptions. It also notifies you of the proposed tax rates of each taxing authority as well as the dates and times those taxing authorities will hold their public meetings to discuss budget. Finally, the TRIM notice also provides a deadline date in which to file a formal appeal with the Value Adjustment Board (VAB) if you disagree with the estimated market value of your property as determined by the Property Appraiser.

Keep an eye out for your TRIM notice this month, if you have questions regarding your TRIM notice, please contact the Property Appraiser’s Office at (850) 248-8401.

- Notices mail November 1

- Online roll available in mid-October, BayTaxCollector.com.

- Owner updates will not show on the Tax Collector’s website until the 2023 roll is available in mid-October.

- Pay by November 30th to take advantage of the 4% discount period.

- You can pay online with an e-check for FREE.

- Once paid, your downloadable statement will show your payment information and can serve as a payment receipt.

Please visit BayTaxCollector.com for more information related to property taxes and the other services provided by the Tax Collector’s Office.