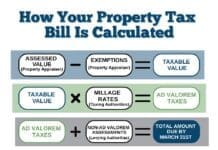

March 1 is fast approaching and the window to apply for property tax exemptions for 2024 is quickly closing. Whether you’re a new Florida resident or have lived in Florida for many years, it never hurts to double-check your exemptions and see if you qualify for additional exemptions.

March 1 is fast approaching and the window to apply for property tax exemptions for 2024 is quickly closing. Whether you’re a new Florida resident or have lived in Florida for many years, it never hurts to double-check your exemptions and see if you qualify for additional exemptions.

“Each year after tax notices are sent we have customers ask how they can reduce their bill, but the opportunity has already passed for that property tax year. I can only direct them to the Property Appraiser’s Office to see if there are any exemptions they may be eligible for next tax year,” said Tax Collector Chuck Perdue.

March 1 is the deadline to apply for property tax exemptions for the 2024 tax year. Homeowners must have been living in their homes by January 1, 2024 to be eligible for exemptions for the 2024 tax year. Exemptions must be applied for at the Property Appraiser’s Office. A list of exemptions and requirements are available on the Property Appraiser’s website at baypa.net.

If you still need to pay your 2023 property taxes, you can pay online at BayTaxCollector.com. Select E-Check as your payment method to avoid paying any convenience fees. The deadline to pay 2023 property taxes is March 31.

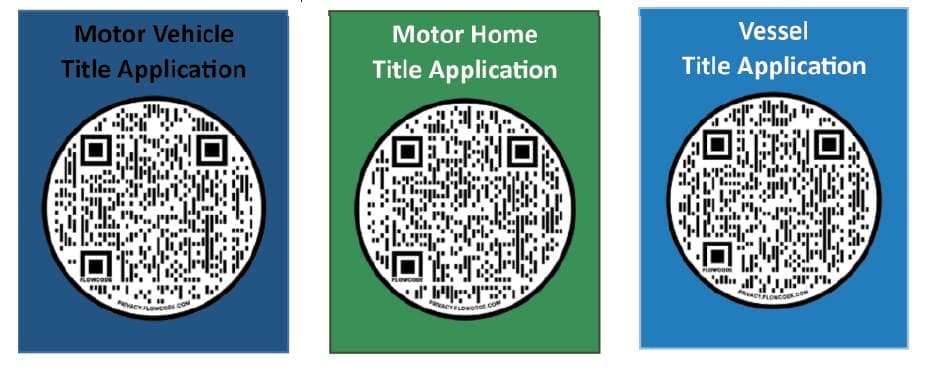

Save Time When Titling a Vehicle – New Requirement January 1

On January 1, a new procedure goes into effect requiring a title application to be completed for each title transaction- vehicle, vessel, and mobile home. If you plan to title a vehicle, vessel, or mobile home in 2024, you can save some time at the tax collector’s office by completing the title application and bringing it with you to your title appointment. Title applications are available online and can be accessed at the QR codes below.

For more details regarding services provided by the Tax Collector’s Office, visit BayTaxCollector.com.