Tips for Easy and Quick Payment

Tips for Easy and Quick Payment

Property tax notices were mailed on November 1 and the property tax roll is officially open for collection. You can now pay property taxes online, by drop box, by mail or by visiting a tax collector’s office. If you haven’t received a physical tax notice, notices can be accessed online at BayTaxCollector.com. Accounts can be searched by property owner, address, or property tax account number.

Here are a couple of tips for customers who want to make paying property taxes as simple as possible:

Pay Online with an E-Check:

The quickest, easiest, and most cost-effective payment option is online payment with an electronic check (e-check). All you need is your checking account number and routing number to pay online with an e-check. Online payment allows you to add multiple properties to your shopping cart and pay all in one transaction. There is no wondering if your mail payment made it to the office on time. Once paid, you can print out your statement with payment information printed at the bottom to serve as your receipt. The QR code below can be used to access our tax software to look up your account and pay online.

Drop Box Payments:

Drop boxes are located at each of our offices and are a convenient option for individuals who want to physically deliver their payment to the office, but don’t want to spend time in our busy lobbies. If you provide a self-addressed, stamped envelope with your payment, we will also mail you a physical receipt or you can go online and print your statement once your payment has been processed. The payment information will print at the bottom of the statement. Please do not include cash in any drop box transactions.

Reminder for Owners of Escrowed Properties:

If your property is escrowed, your mortgage company will pay your taxes by the end of November allowing you to take advantage of the 4% November discount. You will receive a courtesy copy of your tax notice that will read “This is not a bill.” This notice is simply for your records, please do not send in payment.

Payment by debit/credit cards:

Credit and debit cards can be used online or in-person to pay your property tax bill, but please note there is a 2.5% convenience fee on all credit card transactions, with a minimum of $2.50 and a $2.50 fee for debit card use. Florida law requires the tax collector to pass on any payment processing fees directly to the customer choosing to use the service. This fee is collected by the card processor and not the tax collector’s office.

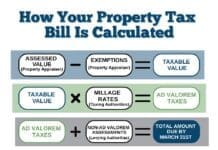

Assessed Value/Exemptions:

If you have questions related to the value of your property or your property tax exemptions, please contact the Property Appraiser’s Office at (850) 248-8401 or (850) 248-8470.

Millage Rates/Special Assessments:

If you have questions related to the millage rate or any special assessment, please contact the taxing district directly.

If you find that you need to visit one of our offices during the busy months of November and December, we strongly encourage you to schedule an appointment or join the line virtually before you arrive to minimize your wait. Use the QR code below to schedule an appointment or join the line.

Please visit BayTaxCollector.com for more information related to property taxes and the other services provided by the Tax Collector’s Office.