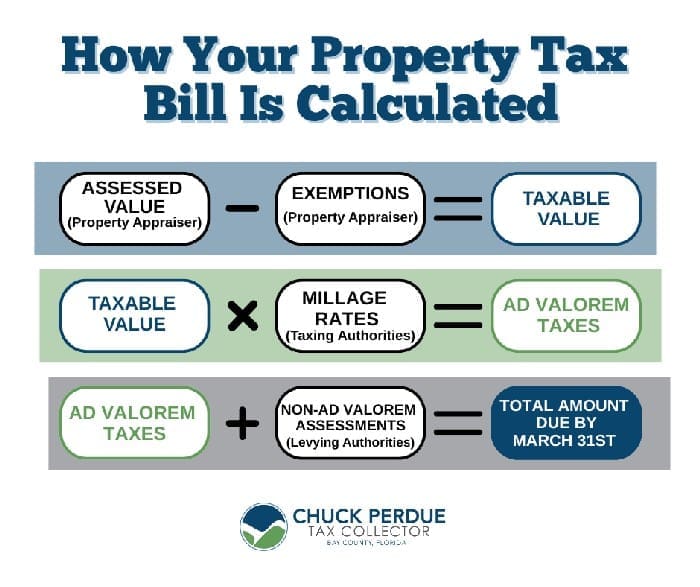

From the desk of Chuck Perdue, Bay County Tax Collector

Each year, once property tax notices arrive, one of the most common questions we hear is: “What can I do to lower my property taxes?”

While the Tax Collector’s Office understands the concern, Florida law limits the ways we can reduce property taxes. Other than the early payment discounts outlined in Florida Statutes, the Tax Collector is not authorized to offer property tax reductions.

That said, there is an important step property owners can take to ensure they’re paying the lowest amount possible– applying for all property tax exemptions for which they may qualify.

Florida offers several property tax exemptions, each with specific eligibility requirements. A full list of available exemptions and qualification details can be found on the Bay County Property Appraiser’s website at BayPA.net.

It’s also important to keep deadlines in mind. The deadline to apply for property tax exemptions is March 1 each year. If your exemption application is approved, it will be reflected on your property tax notice issued the following November.

The most widely known—and often the most impactful—exemption is the Homestead Exemption, but there are several other exemptions available for qualifying property owners, including:

- Widow/Widower Exemption

- Senior Longevity Exemption

- Senior Exemption (with limited income)

- Disability Exemption

Taking the time to review these exemptions and apply by the deadline can make a meaningful difference in your property tax bill. If you think you may qualify, we encourage you to explore your options early and submit your application on time!

For questions regarding exemptions or how to make application, visit the Property Appraiser’s website at BayPA.Net or contact them at (850) 248-8470.

Questions regarding the payment of property taxes or other services provided by the Tax Collector’s Office, visit BayCountyFLTax.Gov. If you need additional information, reach out to our Customer Support Center at (850) 248-8501.