By Randal Locklier, President, Gulf Financial

By Randal Locklier, President, Gulf Financial

What a wild ride it has been for the economy and markets the last few years. Retirees have a lot of obstacles to confront in the quest to build a solid financial plan. There are two wars, political uncertainty, rising interest rates, and inflation that just won’t seem to go away. You may be wondering what steps to take to make sure your retirement plan is in good shape heading into 2024. For most, a focus on the Big Three (Taxes, Income, and Risk) would be appropriate. Let’s tackle these one at a time.

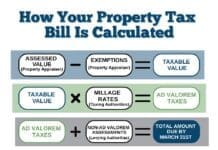

Taxes

It’s no secret that taxes are heading up across the board. Many increases have been legislated and more are on the way. Does it make sense to pay taxes now under low Trump Era rates or wait until they increase? For many it might be a great time for a Roth Conversion. This strategy involves converting IRA assets to a Roth IRA and paying the income taxes in the current period. If early in retirement, this can be a great way to get tax free income in the future. Additionally, tax efficiency can be achieved utilizing a mix of account types, trusts, tax deferral and tax-free investments like municipal bonds.

Income

The most common question we get when meeting for the first time with prospective clients is: How can I generate enough income with my retirement savings to maintain a certain lifestyle AND not run out of money? At Gulf Financial, income is job one. If we can create enough income the rest of the plan becomes simple. Fortunately there are a number of ways an independent Fiduciary advisory can create income. With interest rates at a 30 year high, it’s a great time to buy Fixed Income instruments such as CD’s, Pension Annuities, structured notes, dividend stocks, and high quality corporate bonds. We are seeking to create yield (that means earnings) in client portfolios above 6 percent at a very low risk to principal. As we near or enter retirement our focus must shift from growth to asset preservation and income. When buying Fixed Income, utilize a ladder strategy and buy several different maturities at once.

Risk

Most economists and stock analysts perceive that there is significant risk in the current market. There are a few economic indicators that would suggest we are heading for recession and market correction sometime in 2024. The first indicator is what we term an inverted yield curve. That’s when the 2 year treasury bond pays more than the 10 year treasury. That’s the current situation. A recession has occurred 100% of the time this has happened in the past. It may not happen again but we are ready if it does. Another indicator is the Price/Earnings (PE)ratio of the market. PE ratio is a valuation measure. It is very high now and that’s a signal that stocks are overvalued and ripe for a pullback. Our experience tells us most retirees are far too aggressively invested in mutual fund and etf portfolios. Reduce risk by hedging your bet with risk-free, principal-protected, and buffered products in the Fixed Income markets. Consider reducing equity exposure and increasing your cash position as current money market rates are approaching 6%. Any large drawdowns are destructive and catastrophic to a retirement plan and must be avoided.

It’s a great time for a second opinion. Analyze your current portfolio and take steps now to protect your future. Consider an Independent Fiduciary Advisory like Gulf Financial, required by law to always act in your best interest.

Happy Holidays from the Gulf Financial Family to yours! Be happy, safe and blessed!