There are many reasons people buy physical silver, but the two primary ones are as a long-term savings account (as a hedge against inflation) and as a preparation for a financial-system collapse (as a way to effectively barter). During unusual times, silver can be a good ‘investment’ providing a short-term high return versus inflation, but that should rarely, if ever, be a primary reason for buying physical silver as the majority of the increase often happens before you decide to “buy-in.”

There are many reasons people buy physical silver, but the two primary ones are as a long-term savings account (as a hedge against inflation) and as a preparation for a financial-system collapse (as a way to effectively barter). During unusual times, silver can be a good ‘investment’ providing a short-term high return versus inflation, but that should rarely, if ever, be a primary reason for buying physical silver as the majority of the increase often happens before you decide to “buy-in.”

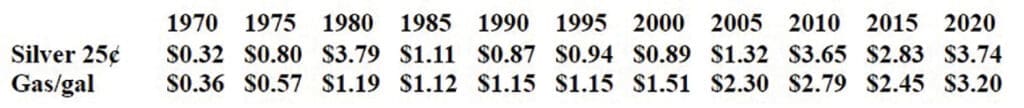

So how do we know silver is a good hedge against inflation? Please see the chart that compares the real intrinsic value of a silver quarter from 1964 to a gallon of gas.

As you can see those prices are pretty close with four notable exceptions: 1980, 2005, 2010, and 2020.

There are exceptions to every rule and events can temporarily disrupt the price of a commodity (like silver or gas). In 1980, the Hunt Brothers cornered the silver market. In 2005, Hurricane Katrina disrupted gas production and refining. 2010/11 was the end phase of the 2008/09 financial crisis. And, as we all know 2020 was defined by COVID (uncertainty plus lack of economic activity).

But over time…a silver quarter IS a gallon of gas! Silver has held steady against inflation for the past fifty years. It has the numbers to back up the proposition that silver is a good “alternative savings plan.”

If you are seeking an ‘investment,’ silver can serve that purpose, but only if you are willing to be patient. If you ‘save’ with silver, you will have it when the ‘something’ happens and prices spike; you can then decide whether or not to cash in part or all of your silver to wait for things to calm down (and buy more silver with the same money).

But when will silver go up? Well, currently it is averaging between $25 and $27 per ounce, For the prior six years it mainly stayed between $14 and $17. We are currently in one of those times defined by uncertainty that tends to drive up prices in ‘safe investments.’ We are expanding the money supply rapidly (which should lead to higher inflation). Silver may settle a little lower for a while and then trend upwards to rebalance with inflation (and a gallon of gas). Silver could explode well past $30 per ounce in reaction to a new financial crisis. No one can know or predict the exact pattern of silver prices over the short term (and if they pretend that they can do so, stop listening to them). What we can do, backed up by long-term historical data is look at silver as a good hedge against inflation.

And just in case of financial collapse, silver coins are easier to carry around than canned goods.

Author James Brock is a numismatist at Coin and Bullion Reserves.