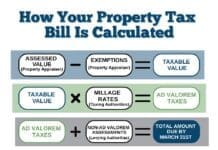

What You Need to Know Before Visiting the Tax Collector’s Office this Year

By Chuck Perdue, Bay County Tax Collector

By Chuck Perdue, Bay County Tax Collector

If you’ve visited the Bay County Tax Collector’s Beach Office on Hutchison Boulevard, you know our building is not large, throw in social distancing guidelines and customer space is compromised further. As property tax season approaches, we want to be sure our customers are aware a visit to the office is not necessary to pay property taxes.

Property tax notices will mail November 1st as always, which means most taxpayers will receive their notice by the second week of November. However, even before your notice hits the mailbox, you can access your online notice and pay online. Property tax accounts are typically accessible online the last week of October.

Some things to keep in mind this November:

If your property is mortgaged, the mortgage company is required by law to pay during the November discount period. Customers with a mortgage will receive a courtesy notice that reads “this is not a bill.” Please simply keep this notice for your records. No other further action is required.

Online payments are highly encouraged. Customers can pay online with an e-check without paying any convenience fees. After paying online, you can print the tax notice with the payment date and receipt number noted at the bottom for your records.

Mailed in payments are posted within 24 business hours of receipt of the payment. It can take up to 48 hours for the payment file to post online. Please check our website before calling or emailing our office regarding receipt of your payment. When mailing in your payment, please make sure you reference your account number(s) on the check.

Drop boxes are available at all offices for check and money order tax payments. Payments are posted the following business day.

When sending in payment via mail or drop box, please only pay one amount based on when you are sending in your payment.

We strongly encourage you to skip a visit to our lobby to pay your property taxes in person and pay online, by mail or drop box instead.

We truly appreciate the opportunity to serve you and thank you for helping us keep our community and team safe by minimizing lobby traffic and completing as many services as possible online.

2020 Property taxes are not delinquent until April 1, 2021.

Homestead exemptions must be filed with the Property Appraiser’s Office by March 3rd to be applicable for the 2021 tax year. You can file online at baypa.net.

You can access services easily by visiting our website, BayTaxCollector.com.

If you need to visit our office for a transaction which cannot be completed online or by mail, please visit our website to schedule an appointment.